Swiss To Vote On Federal Inheritance Tax Wsj

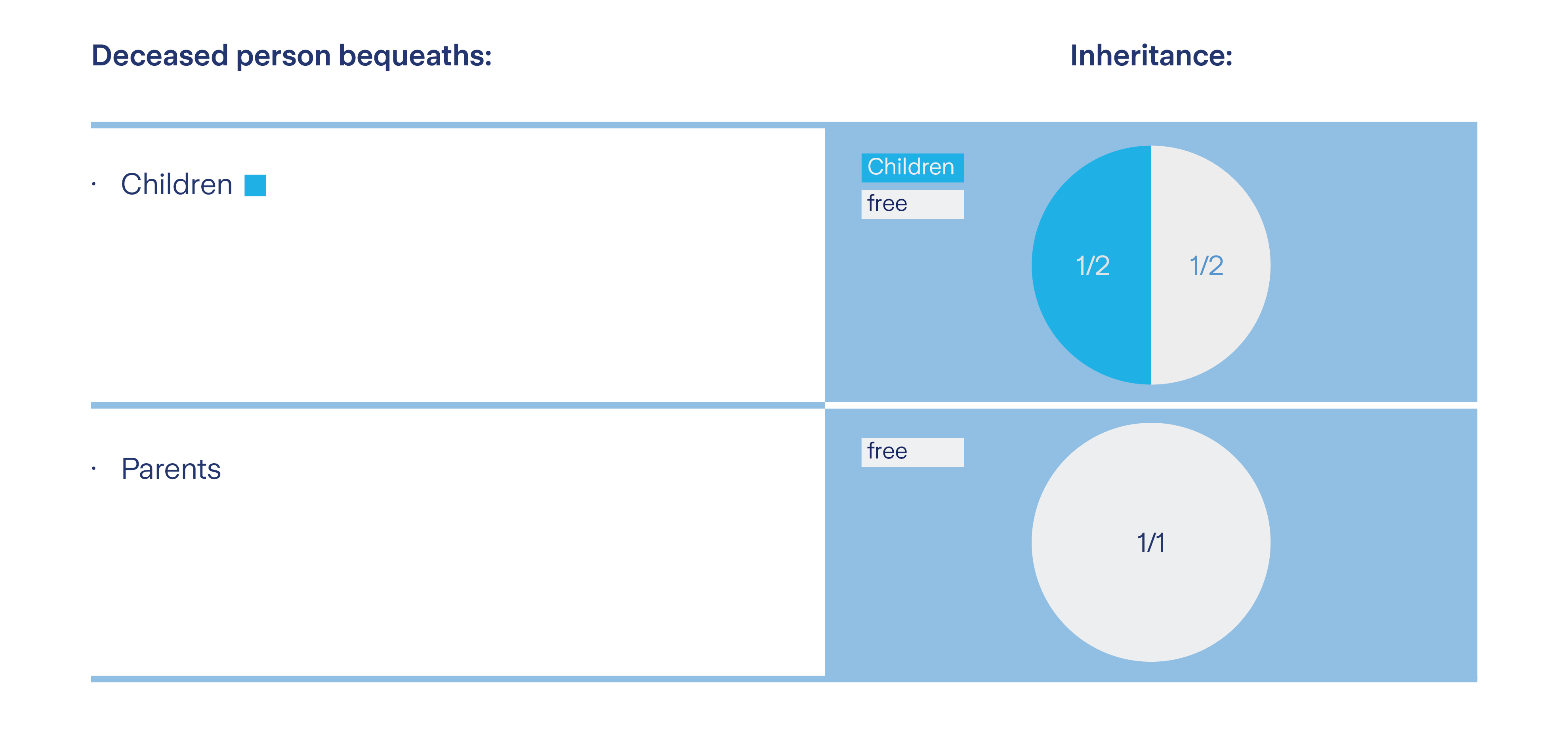

Spouses and descendants arent charged inheritance tax in Zurich Other heirs are split into six groups. In the canton of Zurich spouses and direct descendants are exempt from gift and inheritance taxes Parents have a tax-free allowance of CHF 200000 and. The amount of tax that the heirs pay varies from canton to canton A certain amount is usually tax-free In most cases partners who are married or living in a registered partnership and. Guide to Swiss Inheritance Tax Law for Swiss residents and non-Swiss residents covering the five methods for setting inheritance tax rates in Switzerland Swiss Gift Law inheritance of foreign. In Zurich grandparents parents step-parents uncles aunts nephews nieces siblings stepchildren have to pay inheritance tax whereas spouses and..

Cases where inheritance tax is imposed Cases where a gift tax is imposed Selecting taxation system for settlement at the time of inheritance. Inheritance tax sōzokuzei in Japan is a tax paid by someone who inherits money or property from someone who has died In Japan it is paid as a national tax between 10 and 55 after an. 91000000 JPY x 30 27300000 JPY 45500000 JPY x 20 9100000 JPY. Lets take a deeper dive at how Japan inheritance tax works and look at how it would be calculated In general inheritance taxes apply to property money or assets. How is inheritance tax calculated The Japanese inheritance tax is assessed based on the fair market value of the property or asset at the time of death minus any liabilities funeral..

Key Takeaways Inheritance tax is a levy on assets inherited from a deceased person An inheritance tax is levied on the value. An inheritance tax is a tax beneficiaries pay when they inherit assets from someone who has died. Federal estate tax The gross estate The gross estate for federal estate tax purposes often includes more property than that included. Get information on how the estate tax may apply to your taxable estate at your death The Estate Tax is a tax on your right to transfer property at your death. An inheritance tax requires beneficiaries to pay taxes on assets and property theyve inherited from someone who has died..

Beginning January 1 2011 estates of. Starting in 2023 individuals can transfer up to 1292 million to heirs during life or at death. Nuray Bulbul November 20 2023 at 431 AM 5 min read Jeremy Hunt has faced pressure from some. Kentucky and New Jersey have the highest rate at 16 Iowa is phasing out its inheritance tax and by..

New Inheritance Law 2023 Everything You Need To Know Zurich Switzerland

Komentar